oklahoma franchise tax online filing

To use Free File software taxpayers must have an adjusted gross income of 66000 or less. Nonprofits are exempt from Franchise Taxes unless total capital exceeds 200000.

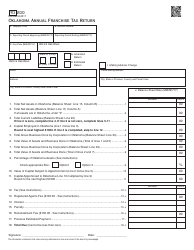

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

In this post we discuss just how far the state can cast its net.

. Agreements as to law enforcement - Equipment - Charges. All formal business entities including Nonprofits are required to have a Registered Agent on file with the state at all times. Enter your customer ID number and PIN.

Current Year Tax Forms. Or you can avoid the hassle of filing all together and hire us to do. Enforcement of laws Costs Authority of other entities.

Foreign Nonprofits must pay a registered agent fee of 100 to the Oklahoma Tax Division via Form 200. Oklahoma Electronic Toll Collection Act - Definitions - Imposition of toll evasion violation penalties. Businesses can close their tax accounts on INTIMEIf a business does not have an INTIME account then it is required to send an Indiana Tax Closure Request Form BC-100If the tax account isnt closed on INTIME or the BC-100 isnt filed DOR may continue to send bills for estimated taxes.

Filing Your Michigan Annual Report. Box 1033 Jackson MS 39215-1033 Physical Address. Department of Revenue Services.

The annual tax payment is due with LLC Tax Voucher FTB 3522. Terms restrictions and conditions apply. What is not similar however is the structure and rate of this tax.

Office of Tax and Revenue. You must file an amended return with another paid tax preparation company andor online provider by the IRS filing deadline and submit your claim within 90 days of filing the amendment with proof that IRS accepted the positions taken on the amendment. FRANCHISE TAX BOARD PO BOX 942867 SACRAMENTO CA 94267-0008.

LLCs are not subject to the annual tax and fee if both of the following are true. Use FTB 3522 when paying by mail. The states definition of residency is very broad and the Franchise Tax Board.

If you are not the Master logon but have cancelled your online access and want to reactivate it you will need to have the Master logon reinstate your access by following these. Oklahoma Secretary of State - Business Filing Department. This page will be updated regularly as more agencies open e-filing.

If filing a Consolidated Franchise Tax Return for Oklahoma the Oklahoma franchise tax for each corporation is computed separately and then combined for one total tax. These availability dates apply to e-filed returns. Each state has different tax and filing requirements so it may be advantageous for your company to foreign qualify.

Go to the LARA Corporations Online Filing System. Mail this form and your check or money order to. Due to federally declared disaster in 2017 andor 2018 the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes.

Most offices are. If you are the Master logon and have cancelled your own online access you will need to contact the Oklahoma Tax Commission Help Desk at 405521-3160 to have your online access reinstated. For California companies the franchise tax will be either a percentage of their income or 800 whatever is larger.

The Free File Alliance is a group of tax-preparation and tax-filing software vendors and online filing services that has agreed to make free versions of its paid products available to eligible taxpayers. 500 Clinton Center Drive Clinton MS 39056 Phone. This article will help you determine what return types you can e-file through Lacerte and when youll be able to start e-filing each return for tax year 2021.

Our instructions also include due dates filing fees required information and answers to questions you may have along the way. Office of Tax and Revenue. Click on a tax type below to get started.

See IRSgov for details. How does California determine residency for tax purposes. The 800 minimum franchise tax is the minimum franchise fee that a corporation will have to pay to operate in California which is similar to the tax situation in many states.

Current Year Tax Forms income taxes Colorado. Oklahoma Electronic Toll Collection Act - Short title. If no payment is due do.

Michigan Annual Reports must be submitted using the LARA Corporations Online Filing System OR by mailing the pre-filled form the state will send your resident agent 90 days prior to your filing due date. Current Year Tax Forms. Complete Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax to determine the combined taxable income to report on page 2 Section Two lines 1825 of Form 512.

Additionally participating vendors may have lower AGI limits or additional. Be aware that closing a business with DOR does not end your obligations to. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis.

Current Year Tax Forms. The agent may be an individual or company with a physical address located in the state of. Contact Information for District Offices and Service Areas Registration - for New Tax Accounts Statewide and Out-of-State Mailing Address.

Paying your annual tax Online Bank account Web Pay Credit card Mail Franchise Tax Board PO Box 942857 Sacramento CA 94257-0631. In addition to filing an annual report every corporation must also pay an annual franchise tax. Do all Nonprofits need a Registered Agent.

Using black or blue ink make your check or money order payable to the Franchise Tax Board Write your social security number or individual taxpayer identification number and 2022 Form 540-ES on it. 601 923-7700 Fax. Same tax facts must apply.

Exceptions to the first year annual tax. The California Franchise Tax Board FTB is aggressive in pursuing its taxes and routinely audits individuals with California ties who claim residency in another state. The following is an easy-to-read guide for how to file the Illinois Annual Report yourself.

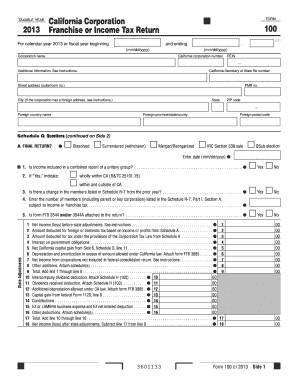

Form 100 California Franchise Tax Board Fill Out And Sign Printable Pdf Template Signnow

Alabama Franchise Tax Return Fill Online Printable Fillable Blank Pdffiller

Usa Oklahoma Oge Energy Utility Bill Template In Word And Bill Template Templates Document Templates

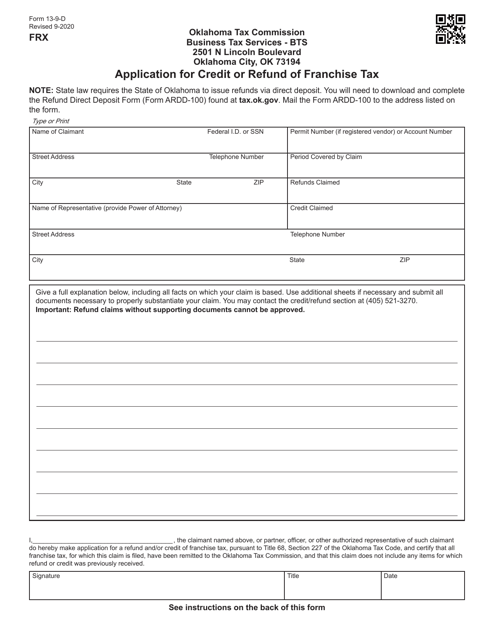

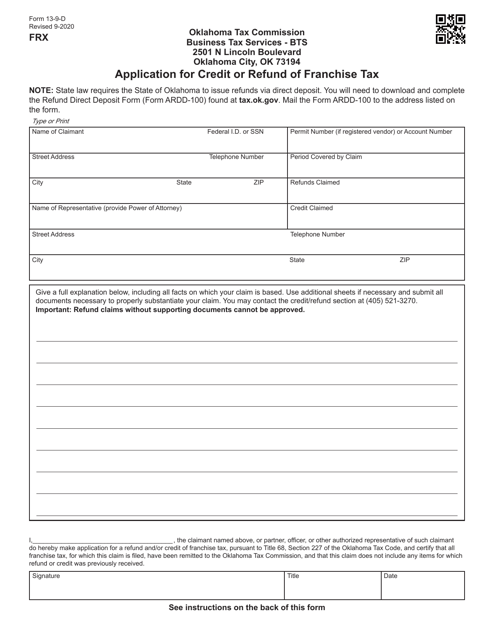

Form 13 9 D Download Fillable Pdf Or Fill Online Application For Credit Or Refund Of Franchise Tax Oklahoma Templateroller

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

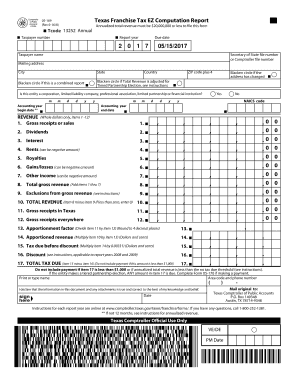

Texas Franchise Tax Ez Computation Report Form Fill Out And Sign Printable Pdf Template Signnow

2021 Form Ok Frx 200 Fill Online Printable Fillable Blank Pdffiller

Franchise Tax Board Homepage Tax Franchising California State

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller